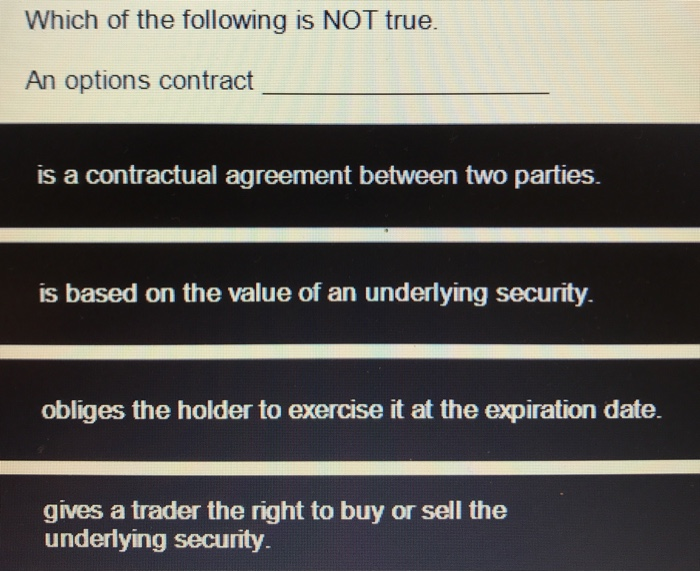

Which of the Following Is Not True an Options Contract

An option contract is out the money if. The buyer of a put option has the right to sell the currency at the strike price.

Stock Market Tips Options Alerts And A Simple Method To Minimize Risks And Maximize Returns In 2021 Stock Market Marketing Data Trading

B A put option gives the holder the right to sell an asset by a certain date for a certain price.

. Longer term stock options known as LEAPs Long Term Equity AnticiPation options have a. Intrinsic value is the same thing as the in the money amount. Investors must pay an upfront price the option premium for an option contract D.

A European option can only be exercised only on the maturity date C. The offer cannot be revoke during the option period. Which of the following statements regarding option contracts is true.

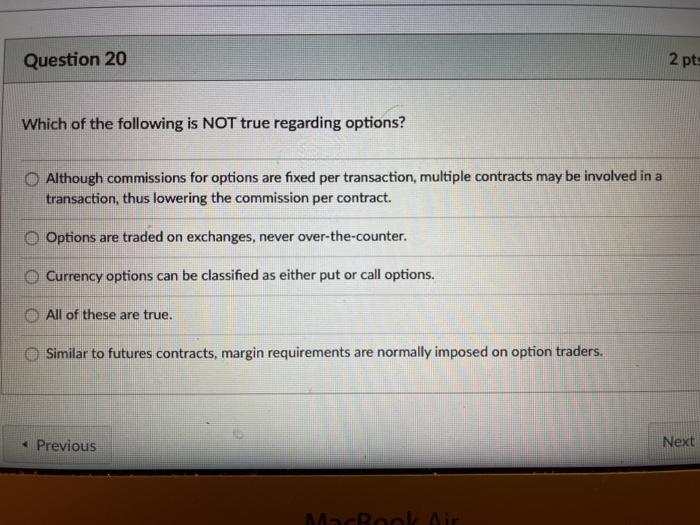

If the spot rate on the expiration date is 58 your net profit per unit is. Options contracts do not require consideration. Which of the following is NOT true regarding options.

A recorded option in a contract by which the owner of property gives another person the right to purchase his property for a stated sum. Which of the following is NOT an example of a bilateral contract 1 A purchase and sale contract between a buyer and seller 2 An option contract Submitted answer 3 An exclusive right to sale listing agreement between a seller and a broker 4 A lease agreement. You purchase a put option on Swiss francs for a premium of 02 with an exercise price of 61.

Death or incompetency of either party terminates an option contract. Based on these facts alone which of the following is true. The buyer of a call option has the right to buy the currency at the strike price.

Sidway the key contract element in. The buyer of a put option has the right to sell the currency at the strike price. The option will not be exercised until the expiration date if at all.

Mariah and Edward most likely do not have a contract as she was merely soliciting bids. The best answer is A. The longer the maturity of the option the higher the premium.

Exercise is unprofitable to. The best answer is B. Intrinsic value is the profit to the holder that would result from an exercise ignoring premiums paid.

Which of the following is NOT true about call and put options--A. Currently the way that options are issued the actual maximum life is 8 months. An opening transaction to buy a position results in a short position in the option.

The price of a call option increases as the strike price increases. Which of the following is true regarding option pricing. The writer of a call option has the obligation to sell the currency to the buyer if the option if exercised.

All equity put and call option contracts represent 100 shares. Rules the maximum legal life of a regular stock option contracts is. A The holder of a swap contract is obligated to buy or sell an asset and the swap is financially settled.

If money is paid as consideration then that is not applied to the sale price. C The holder of a put or call option must exercise the right to sell or buy an asset. Option prices are less volatile than equity prices.

Which of the following is true about an option contract. If the offeree chooses not to buy the property then money paid in consideration must be returned B. The writer of a call option has the obligation to sell the currency to the buyer if the option if exercised.

In the case of Hamer vs. Legally the maximum life of a regular stock option contract is 9 months. The buyer of a call option has the right to buy the currency at the strike price.

The time value of an option is typically higher for option contracts with deferred delivery periods compared to options contracts with nearby delivery periods. A contract in which a landowner gives a developer for a stated consideration the right to buy a parcel of land within a specified time for a fixed price may properly be described as. An American option can be exercised at any time during its life B.

The more volatile the underlying stock the lower the premium. Which of the following is not true regarding options. True A call option is out of the money when the market price of the underlying futures contract is.

Only European-style options can be exercised prior to the expiration date. Longer term stock options known as LEAPs Long Term Equity AnticiPation options have a maximum life of 30 months. The maximum life of a regular stock option contract is 8 months this may be tested as 9 months though.

How To Read An Options Alert Stock Options Trading Stock Trading Strategies Stock Trading Learning

Speeding Tickets For Life Mommas Slow Down Nanahood In 2021 Slow Down Quotes Quotes About Motherhood Momma Quotes

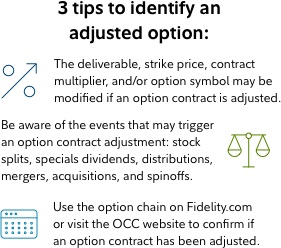

Option Contract Adjustments Fidelity

Atomos Ninja False Colors To Zone Exposure Guide Cinematic Lighting Exposure Guide

Best Friend Gifts Best Friends Contract Friendship Bracelet Etsy Friendship Day Gifts Friend Birthday Gifts Letter To Best Friend

Solved Which Of The Following Is Not True An Options Chegg Com

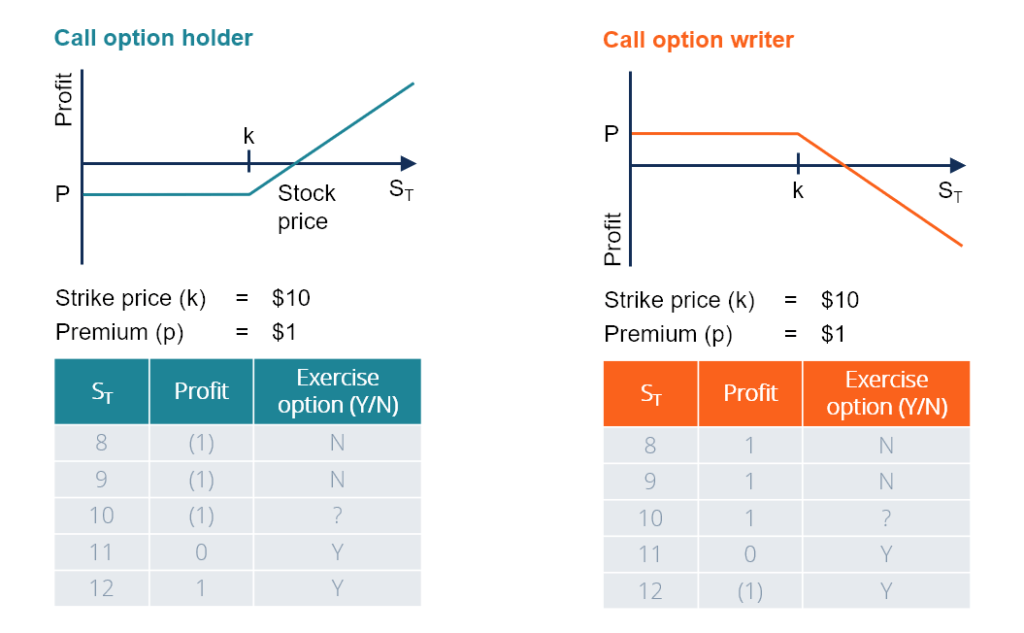

Call Option Understand How Buying Selling Call Options Works

Popular Funny True Stories Notalwaysright Com Funny True Stories Stupid People Not Always Right

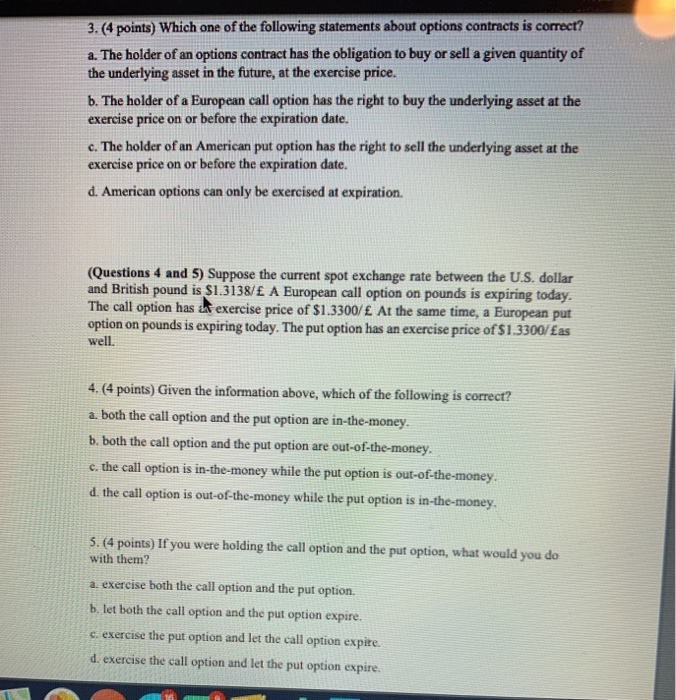

Solved 3 4 Points Which One Of The Following Statements Chegg Com

Solved Question 20 2 Pts Which Of The Following Is Not True Chegg Com

Couple Bracelets Succulent Gift Box Long Distance Etsy Cute Couple Gifts Distance Relationship Gifts Christmas Gifts For Couples

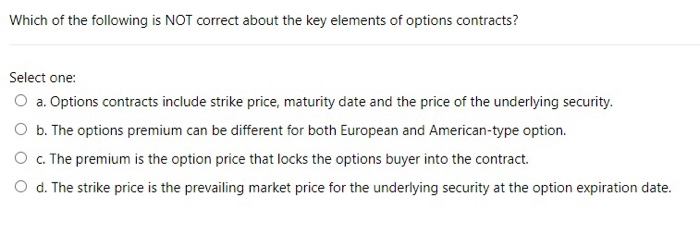

Solved Which Of The Following Is Not Correct About The Key Chegg Com

To Accomplish Great Things We Must Not Only Act But Also Dream Not Only Plan But Also Believe Anatole France How To Plan Accomplishment Acting

/TheImportanceofTimeValueinOptionsTrading1_3-ad26c7e621bb4a19ae4549e833aab296.png)

The Importance Of Time Value In Options Trading

Natural Birth Plan Template 14 Tendency To Try Out Birth Plan Template Birth Plan Natural Child Birth

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Comments

Post a Comment